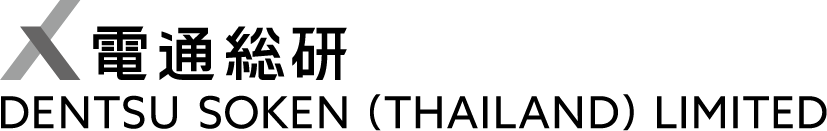

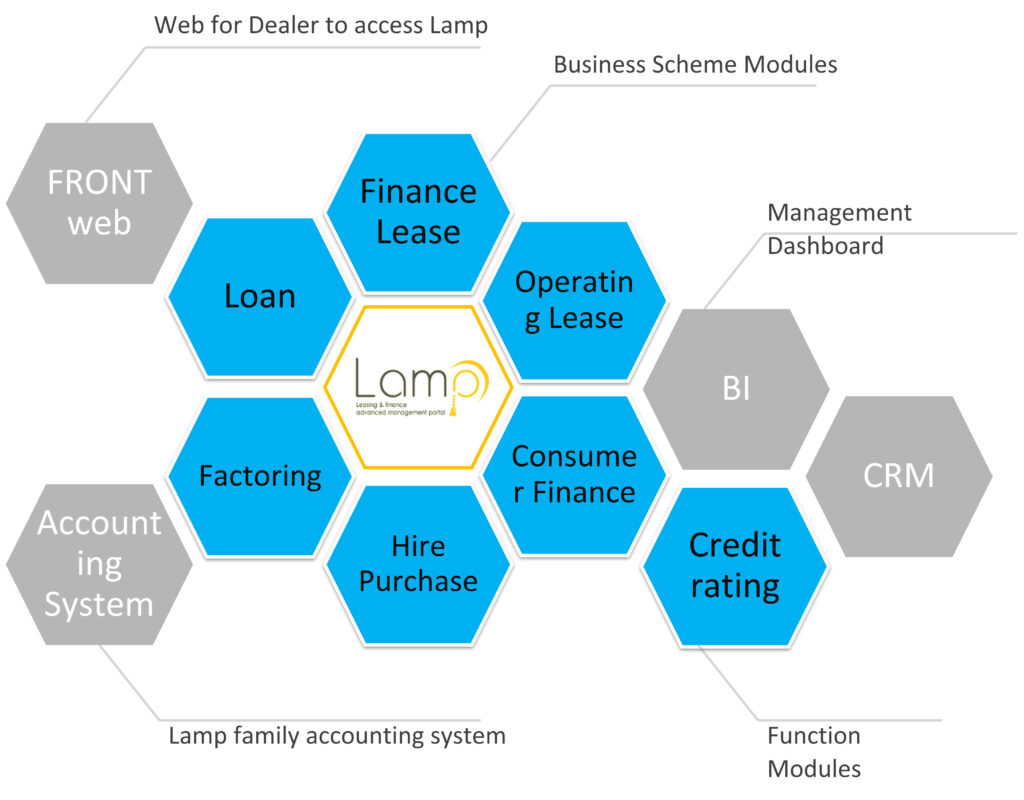

In addition to covering core operations such as application management, contract management, billing collection management, and urge management, it also supports peripheral operations such as the front-end web system used by agents and BI tools that can be used by headquarters staff for management analysis based on operational data, thereby realizing efficiency and rigor in the entire operation.

Recently, we have also begun to handle various lease-related schemes, such as automobile maintenance leasing, dealer financing, and Japanese-style operating leasing, as well as highly specialized unsecured card loans for individuals by combining our credit scoring system and front-end web system.

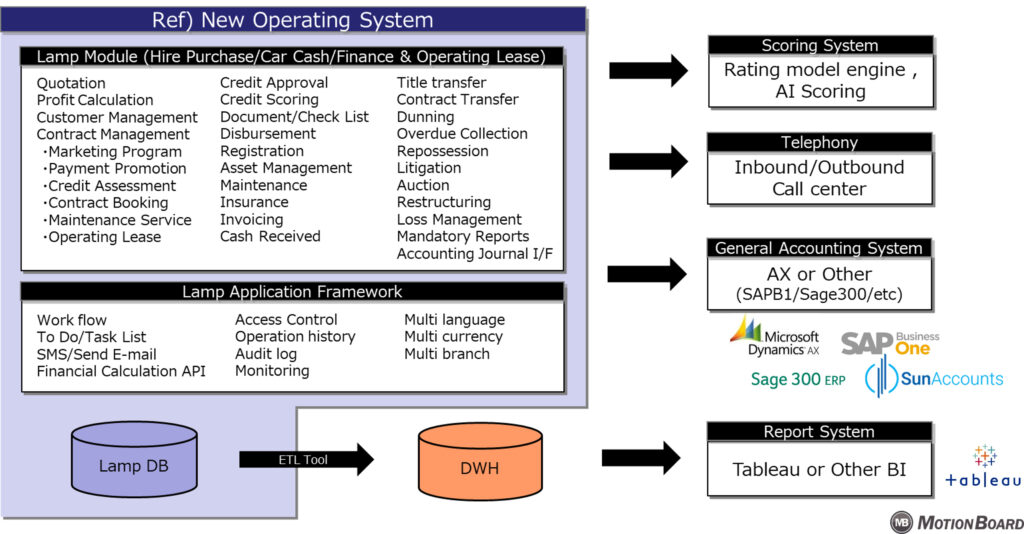

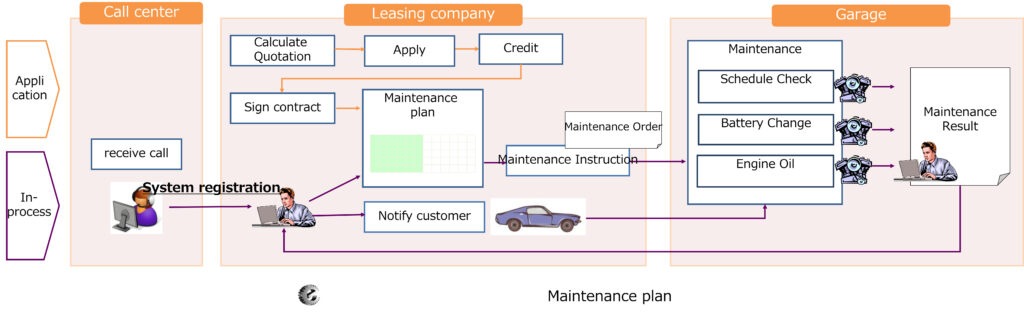

Auto lease / Full-service lease

Manage on Leasing / Maintenance schedule & History /Analysis profit maintenance and disposal

Introduced an auto maintenance system for leasing companies in Southeast Asia. Using the maintenance plan function, a maintenance plan tailored to each vehicle can be determined at the time of contract. In addition, maintenance forecasts are visualized. Output maintenance orders from Lamp and send work instructions to the Garage. After performing maintenance, you can register the results in the Lamp and then make payment. In response to exceptional cases, we can also create maintenance orders for matters other than maintenance plans (such as accidents)

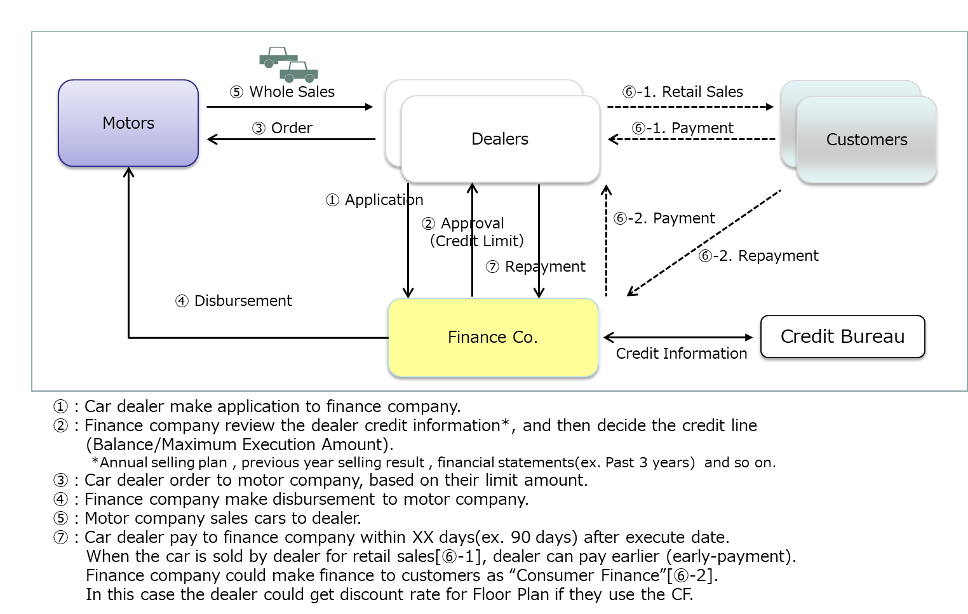

Dealer finance

One of Corporate finance. Floor Plan for Daalder Finance.

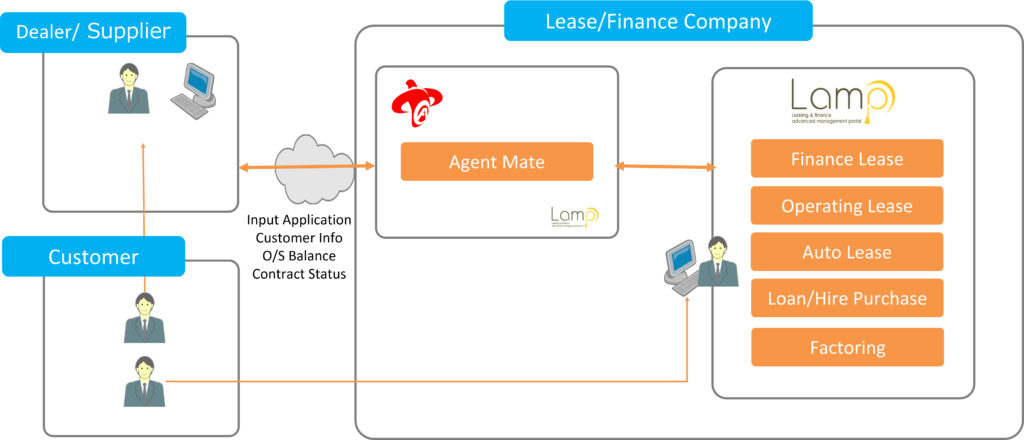

Dealer/Supplier Connect can allow the dealer/ Supplier to input directory information and refer customer information. Lamp delivers seamless data access and inquiry among lease company, dealer and supplier on secure environment.

Features of Lamp

integrated management of leasing and financing operations

We can handle a variety of transactions including finance leases, operating leases, factoring, loans, and installment payments all at once.

In addition, information that needs to be commonly understood, such as customer information, balances, credit information and limits, can be managed centrally.

This is extremely effective for finance companies that handle these types of transactions simultaneously.

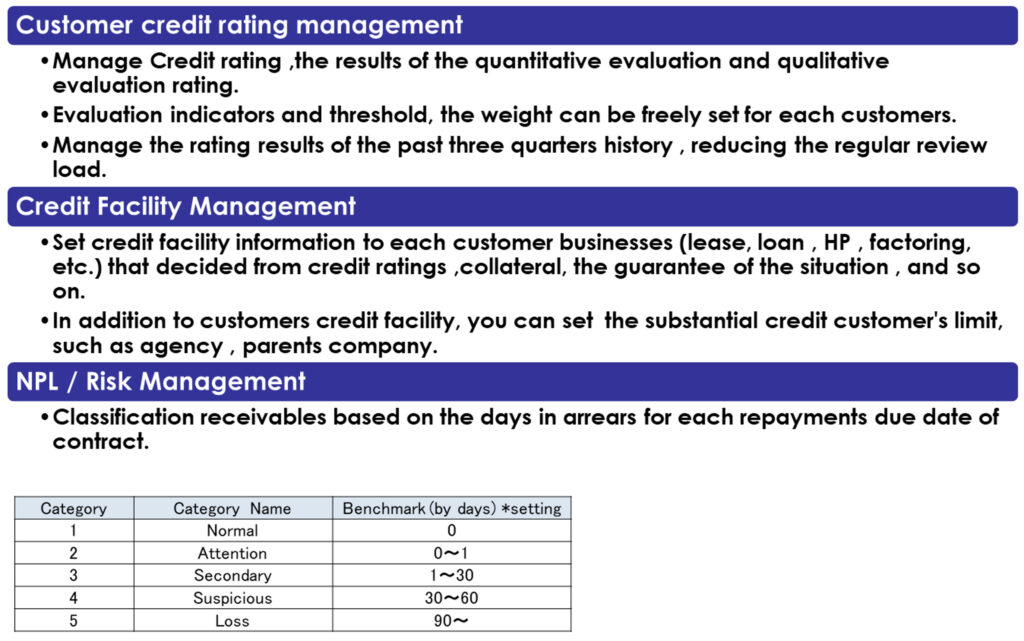

Excellent credit function

“Credit management” is one of the keywords that finance companies have been paying attention to recently.

Lamp’s credit management function is based on the know-how cultivated through “BANK・R,” a credit risk management package that has a proven track record in Japan.

By quantifying the risks associated with business partners and projects, we provide indicators that allow you to make appropriate decisions at any time.

Acquiring and analyzing information from a management perspective

With experience implementing this system at many finance companies, management can easily obtain the information they need from Lamp.

The lamp also has the ability to visually analyze all business data collected, supporting rapid decision-making.

Implementation tailored to business scale/needs

In addition to on-premises implementation, it can also be used as a SaaS, where you pay a regular usage fee.

In addition, by adding/reducing options according to your business area and needs, you can implement a system that suits your business scale.

Furthermore, because it is a package developed in-house by Dentsu Institute Shanghai, it can be flexibly customized to meet needs and add integration functions with peripheral systems.

Supports Japanese, English, and Chinese, and can be used at global locations including Asia.